08 Sep Save for Retirement even living paycheck to paycheck

According to the latest findings from the Reality Check: Financial research series 54 percent of consumers in the U.S. (125 million U.S. adults) are living paycheck to paycheck. The report found that individuals across a broad spectrum of income and age, are living paycheck-to-paycheck.

It may not be easy to save for retirement when living paycheck to paycheck, but it’s also not impossible. With focus and dedication on taking care of your money, you have a great shot at setting up the comfortable retirement of your dreams.

Here are 5 tips on how you can save for retirement even if you are living paycheck to paycheck.

1. Launch a profitable side hustle

With the gig economy growing each year, it’s easier than ever to pick up a side hustle apart from your “day” job. Whether you’re selling crafts on Etsy, driving for Uber, or blogging or are an affiliate marketer, that second paycheck is your retirement savings security blanket.

One of the great things a side hustle offers is flexibility. You work your side hustle when you have time. If you get a second job in say retail, your boss controls your schedule. With a side hustle, YOU are your own boss, and you make your own schedule.

But be sure to make a plan for how you will save money from your side hustle. Those extra dollars can quickly get eaten up in day-to-day living.

2. Get on a budget

Maybe you don’t even know where your paychecks go. Bills. Payments. Food. You’re just keeping things paid and people fed. It’s time to start budgeting. Why? Because when you budget, you tell your money where to go instead of wondering where it went.

When you budget, you’ll see spending habits you didn’t even know you had. Then, you can make the changes you need so you can reach your goals—for right now and far into the future.

I can’t say it enough: Budgeting is the foundation for all money management. It is the first critical step toward ending this paycheck-to-paycheck life. Don’t put it off. Get on a budget.

3. Rein in spending

Examine your budget. You might negotiate a lower rate on your car insurance or save by bringing your lunch to work instead of buying it. Evaluate all of your subscriptions. How much is your phone plan costing you? Can you lower your usage and get on a less costly plan? Use this cash flow calculator that can help you determine where your money is going — and find places to reduce spending so you have more to save or invest.

4. Stop living with debt

Okay, so here’s the deal: Debt holds you back. It’s got you paying off last year’s Christmas presents in June. And then you’re stuck paying off that beach vacation in December. You can’t get ahead like that.

And debt is getting sneakier and sneakier. These days, installment payment companies are on the rise. They tempt you at the checkout by saying you can pay for that French press in four easy payments. Do you really want to sink money into your fancy coffee maker for four months? (No.) Listen. Living with debt (of any kind) is one of the biggest things keeping you in the paycheck-to-paycheck cycle.

Get out of the endless debt cycle!

Here’s how: First, stop taking on any kind of new debt! That means to stop paying for things with a credit card. Don’t take out a new car loan. Say “Heck no” to saving 10% on that cardigan by opening up a store card, which will actually cost you in the long run. Next, kick your debt to the curb by paying it off smallest to largest using the debt snowball.

Think of it like this: When you make your budget, how much of your money goes to debt payments every month? That’s how much extra you’ll take back when the debt is gone. Goodbye, payments. Hello, progress…

5. Automate your savings

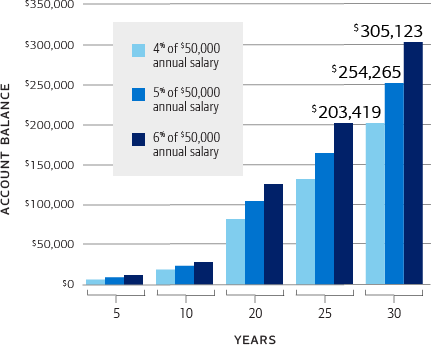

You’ve probably heard the phrase “pay yourself first.” If you can put just $10 per paycheck into an automated paycheck deduction into an IRA account, that $10 a week with compound interest will grow exponentially over time. Making this an automatic payroll deduction means you are saving without having to think about it.

The Bottom Line

Saving for retirement can be challenging, especially when you don’t have a lot of extra money to work with. The trick is to know what money is coming in, and more importantly, how it’s being spent.

Having a budget, and a tight grip on your budget helps you find extra money that you could be saving but have been spending on non-critical items. Every dollar counts, so you need to start counting and controlling every dollar in your household budget.

Keeping a tight rein on your money and starting a side hustle is the winning combination to help you save for and secure your retirement!

Ready to Start Your Side Hustle? We Can Help!

Start your side hustle today with this FREE ebook!

15 Comments on Save for Retirement even living paycheck to paycheck

Excellent blog! Wonderful "How To!" I'm sure it's going to help a lot of people. Congrats.

Hi Beth, Thank you for your kind words. Feel free to share the link to our site with anyone else who may find the information helpful as well. We always work hard to provide useful and relevant content.

Sincerely,

Fred & Kim ~The Biz Wizards

[…] the end of the year how much you can contribute. Because of this, it is critical to create a budget and set aside money throughout the […]

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

Hi Albert, Thank you for commenting. We always work hard to provide useful, accurate, and relevant content, but if you feel our information is inaccurate, please reach out to us, and let us know. If you haven’t already, be sure to subscribe to our site (there should be a pop-up that appears on screen, or you can click on the red button at the top of the page), so you will receive updates and see our new content when it is posted!

Sincerely,

Fred & Kim ~The Biz Wizards

Certainly. I agree with you.

Hi Robert, Thank you for commenting. We always work hard to provide useful and relevant content. If you haven’t already, be sure to subscribe to our site (there should be a pop-up that appears on screen, or you can click on the red button at the top of the page), so you will receive updates and see our new content when it is posted!

Sincerely,

Fred & Kim ~The Biz Wizards

In my opinion you are mistaken. I can defend the position.

Hi Michael, Thank you for commenting. We always work hard to provide useful, accurate, and relevant content, but if you feel our information is inaccurate, please reach out to us, and let us know. If you haven’t already, be sure to subscribe to our site (there should be a pop-up that appears on screen, or you can click on the red button at the top of the page), so you will receive updates and see our new content when it is posted!

Sincerely,

Fred & Kim ~The Biz Wizards

In my opinion you are mistaken. I can defend the position.

Hi James, Thank you for commenting. We always work hard to provide useful, accurate, and relevant content, but if you feel our information is inaccurate, please reach out to us, and let us know. If you haven’t already, be sure to subscribe to our site (there should be a pop-up that appears on screen, or you can click on the red button at the top of the page), so you will receive updates and see our new content when it is posted!

Sincerely,

Fred & Kim ~The Biz Wizards

Rather valuable answer

Hi Anthony, Thank you for commenting. We always work hard to provide useful and relevant content. If you haven’t already, be sure to subscribe to our site (there should be a pop-up that appears on screen, or you can click on the red button at the top of the page), so you will receive updates and see our new content when it is posted!

Sincerely,

Fred & Kim ~The Biz Wizards

I've learn several good stuff here. Certainly price bookmarking for revisiting.

I wonder how much effort you set to create the sort of fantastic

informative site.

Hi Eugenia,

Thank you for commenting. We always work hard to provide useful and relevant content. If you haven’t already, be sure to subscribe to our site (there should be a pop-up that appears on the screen, or you can click on the red button at the top of the page), so you will receive updates and see our new content when it is posted!

Sincerely,

Fred & Kim ~ The Biz Wizards